Timing the Sphere: Why I’m Waiting Until After Earnings for SPHR Calls

After a couple of weeks of research, I’ve decided that I will wait to make a play with call options on Sphere Entertainment (SPHR).

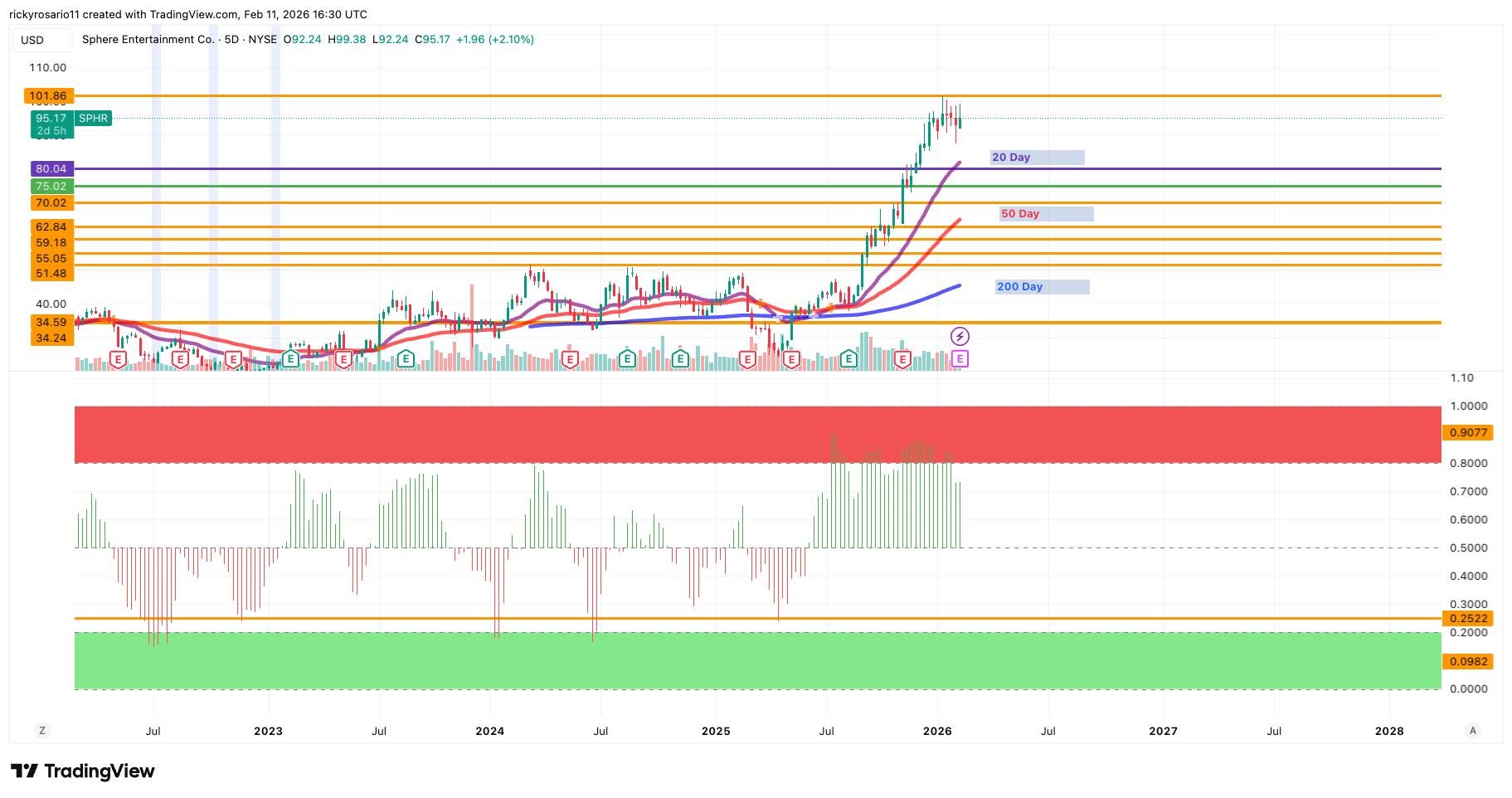

Sphere Entertainment (SPHR) is approaching a major financial pivot this Thursday, with analysts projecting a swing from last quarter’s -$0.85 EPS to a profitable $0.12. This expected revenue jump to over $305M is fueled by a powerhouse Q4 2025 (Oct–Dec) lineup, featuring continued sell-outs from The Eagles, the debut of Anyma’s "End of Genesys," and high-demand holiday runs of The Backstreet Boys and The Wizard of Oz. While the fundamentals are finally turning a corner, the technical charts are flashing a different signal: extreme exhaustion.

The Technical View: Peaking into Resistance

According to the latest technical data, SPHR has gone parabolic, recently hitting $97.10, but the indicators suggest the move is overextended:

DeMark Overbought Signal: The oscillator at the bottom of the chart has entered the deep red zone (hitting 0.9077), a classic signal that the current trend is exhausted and hitting a DeMark sequential peak.

Resistance at $101: The stock is rapidly approaching a major resistance level at $101.86. With the current price significantly extended above the 20-day and 50-day moving averages, the risk of a "mean reversion" pullback is high.

Option Stats: Implied Volatility (IV) is currently sitting at 60.03%. Buying the $92.50 calls now means paying an inflated premium for a stock that is technically "peaking" into a major catalyst.

Q4 2025 (Oct–Dec) Highlights: What’s Being Reported Thursday

This Thursday’s report covers the Sphere's most active quarter yet, including:

The Eagles: Key residency dates throughout October and November.

Anyma & Backstreet Boys: Major holiday debuts and extensions driving Q4 volume.

Zac Brown Band & Lenovo CES Keynote: High-profile B2B and residency launches.

The Verdict: The "Dip and Rip" Play

Despite the "stacked" quarter, my final decision is to wait until after the Thursday announcement. Historically, SPHR drops immediately after reporting because the market fixates on overhead costs—and with the DeMark indicator showing the stock is currently overbought near $100, a post-earnings pullback is even more likely. I am aiming to sidestep the "IV crush" and the technical correction. If the stock follows its usual trend of a post-earnings dip toward the moving averages, I’ll look to secure the $92.50 calls (5/15) at a much cheaper entry point for the eventual recovery "rip" once the technicals reset.